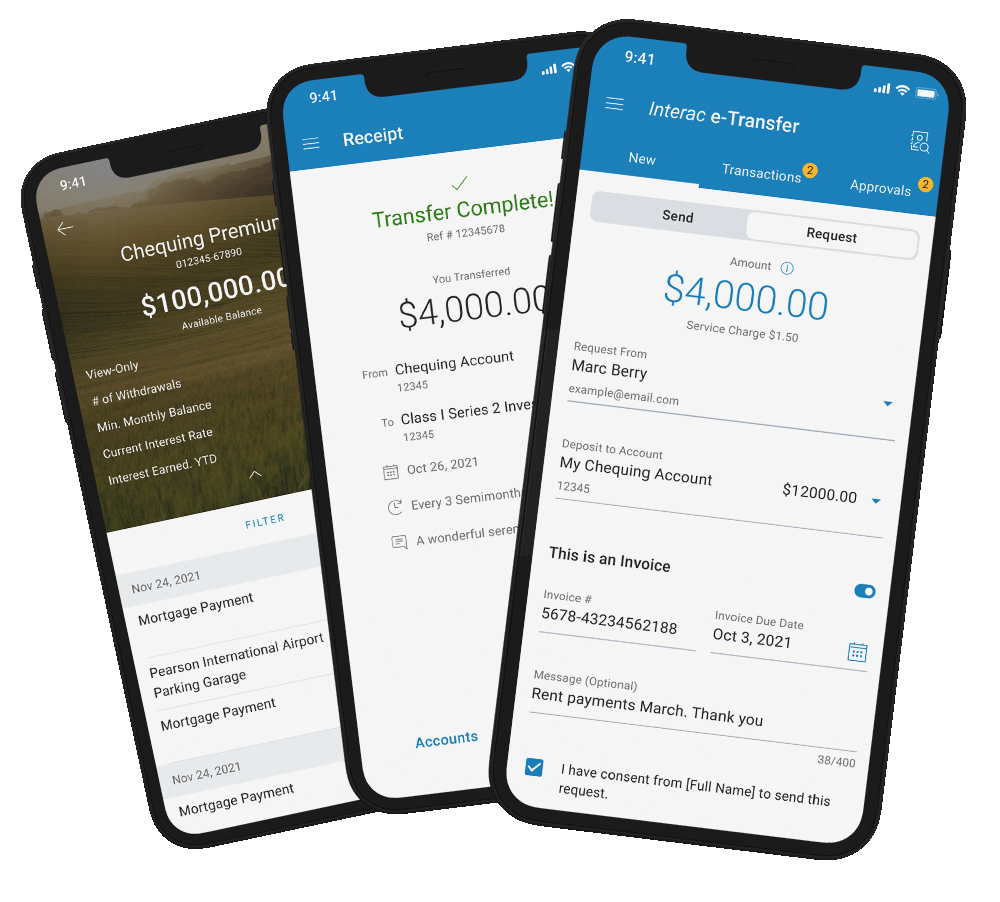

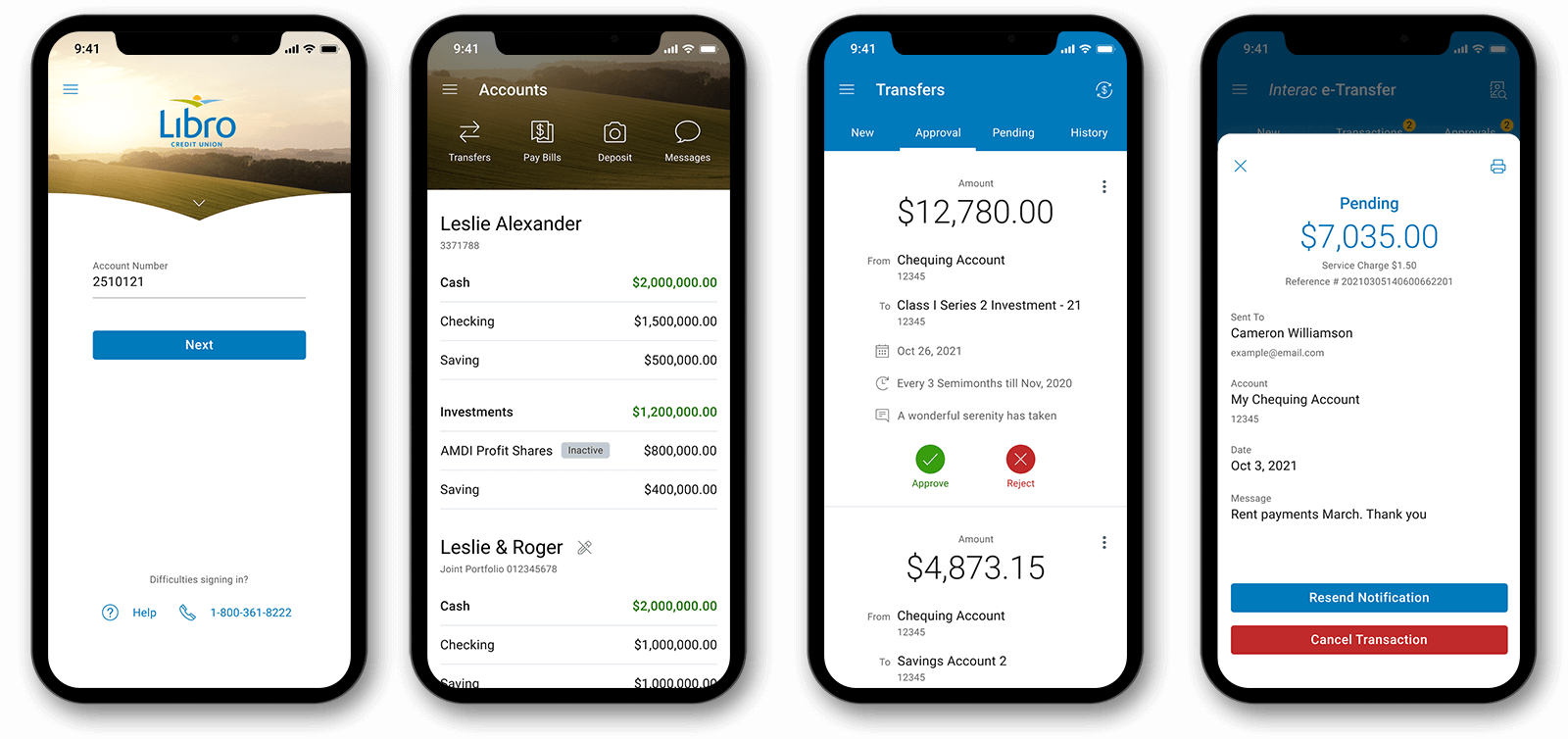

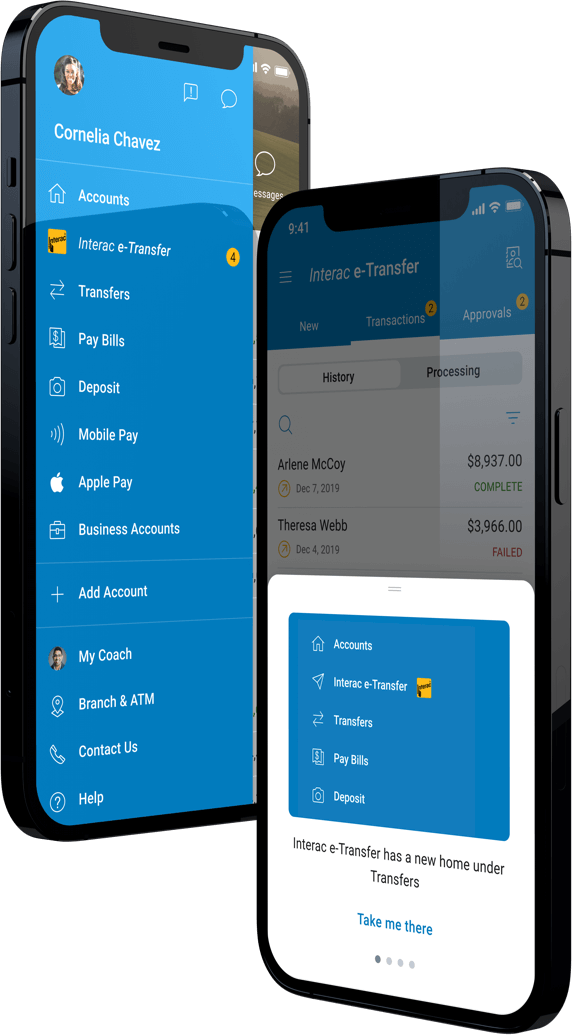

Seamless Online Banking Experience on Mobile Devices

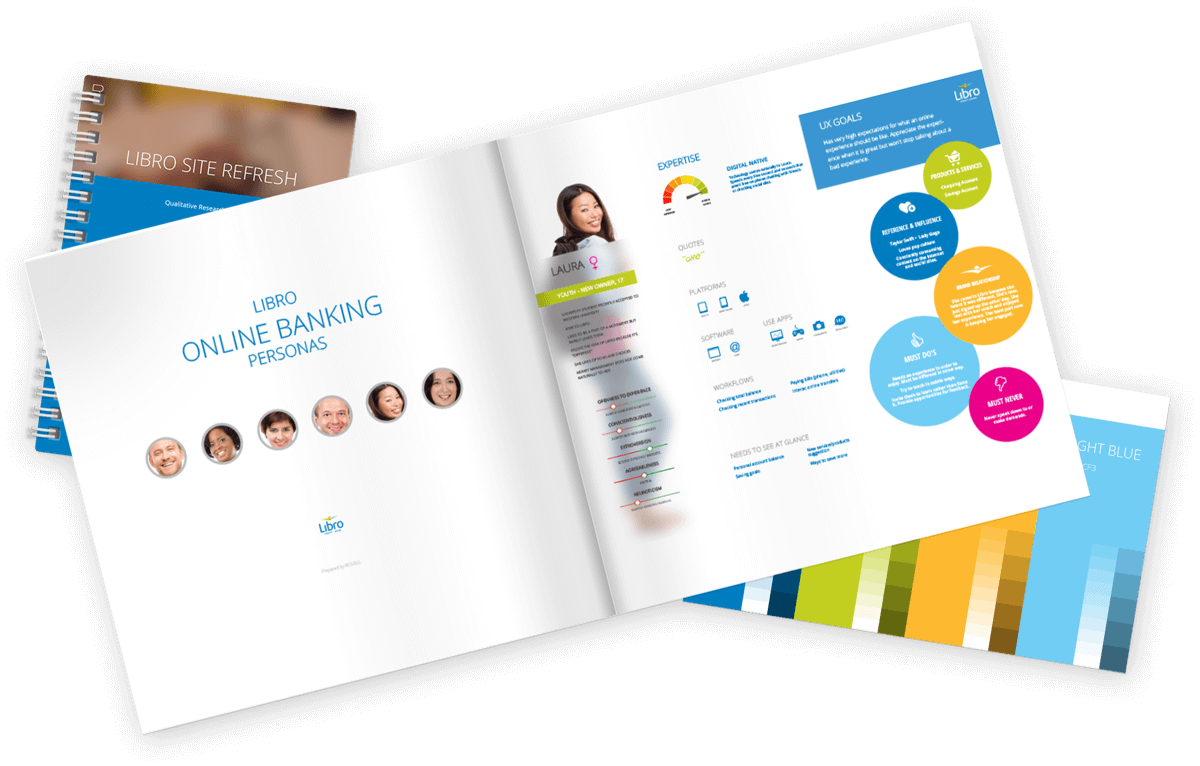

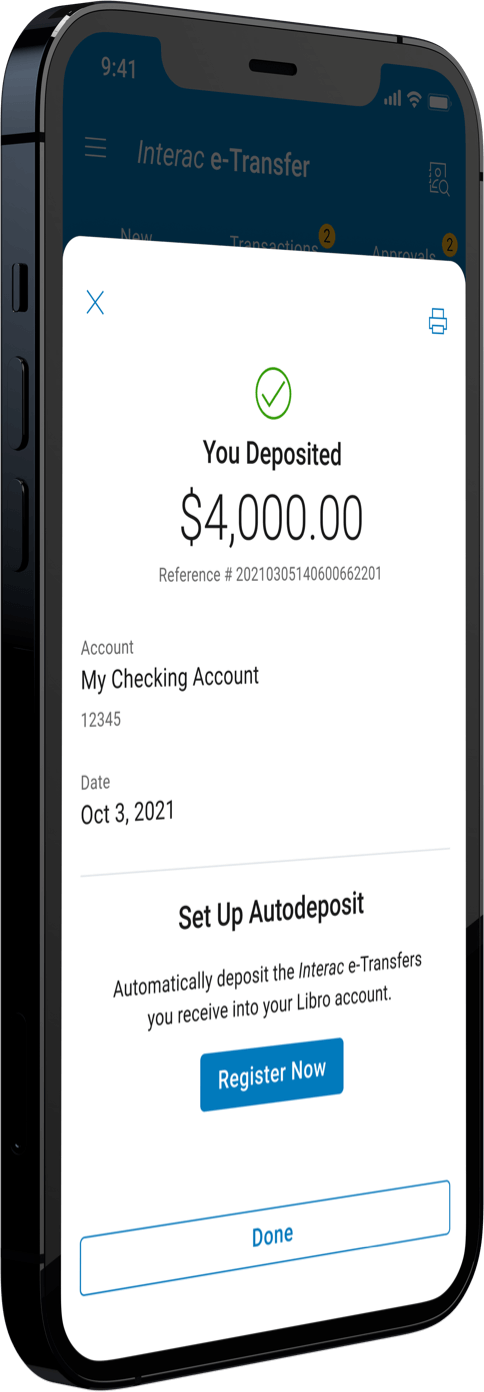

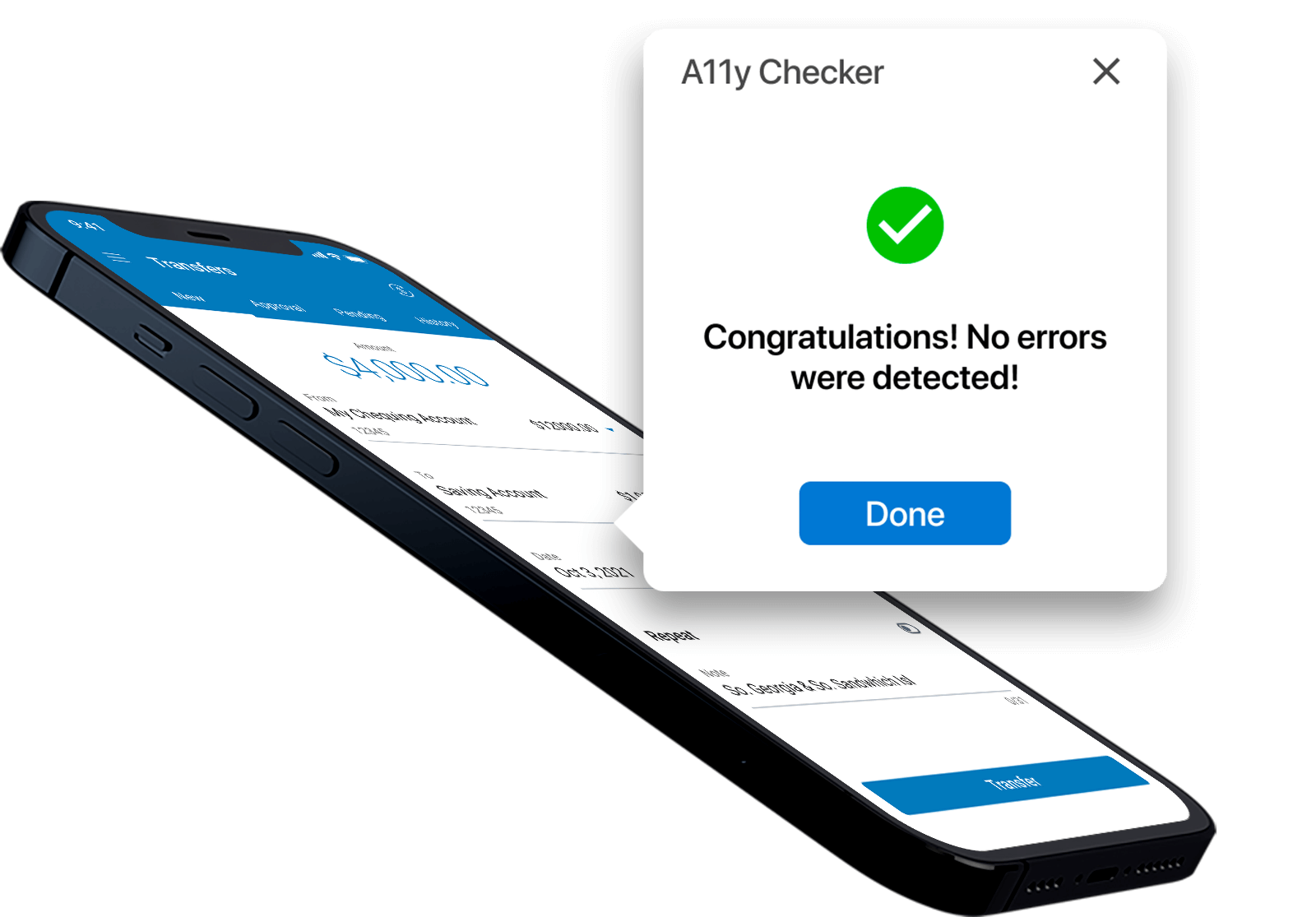

Our goal was to empower users to effortlessly check balances, send money, and pay bills using their smartphones or tablets, while enhancing the mobile user experience, adding new features, and ensuring accessibility.